Activism

/

StudentNation

/

January 24, 2025

Borrowers stand to lose more than they could ever gain if the department is shut down.

President Donald Trump and Linda McMahon, now his nominee for Education Secretary, at Mar-a-Lago in 2019.

(Nicholas Kamm / Getty)

As we transition to a new administration, the future of student loan policies is unclear. With President Trump back in office, potential changes to repayment plans, forgiveness programs, and even the Department of Education’s very existence could deeply damage the future of millions of Americans. In this precarious environment, understanding the current system, preparing for possible shifts, and advocating for protections are more critical than ever.

The student loan system has always been complex. However, recent actions have created additional challenges for borrowers and their families. Policies like the federal payment pause, Fresh Start, and the introduction of the SAVE plan offered temporary relief for many, but these measures were short-lived. With potential rollbacks and administrative changes looming, borrowers must remain vigilant and informed about their options.

Among several recent hurdles in the student loan system, including Republican-led lawsuits against the Saving on a Valuable Education (SAVE) plan and the end of the federal payment pause, the potential for significant changes—or even a total shutdown—within the Department of Education itself is putting extreme stress on student loan borrowers. Despite its shortcomings, the department plays a crucial role in ensuring that borrowers have access to protections and programs that help facilitate student debt relief. Whether it’s resolving servicer issues, determining a lower monthly payment, or creating more flexible eligibility requirements, the Department of Education oversees essential functions in the student loan system.

Dismantling or weakening the department is not a step toward ending the student debt crisis. Borrowers rely on the Department of Education to process applications, enforce servicer accountability, and provide critical updates on policy changes. Additionally, the Department of Education’s employees work tirelessly, despite limited resources, to develop and implement solutions that benefit borrowers.

Transferring the Department of Education’s responsibilities to another agency—the Department of the Treasury, for example—would raise serious questions. Would the new administration prioritize correcting servicer errors, assisting borrowers in need, or enforcing accountability? Or would borrowers face increased confusion and fewer protections? Before any of those issues are resolved, would the new administration develop a comprehensive team to manage the student debt crisis, which has ballooned to more than $1 trillion?

These are the questions that already have answers thanks to the existence of the Department of Education. Many of the most impactful relief initiatives like Public Service Loan Forgiveness, IDR plans, and the recent One-Time Account Adjustment were designed and/or are implemented by the department. Without the agency, the development of new borrower-friendly programs would stall entirely, leaving millions of Americans with fewer paths to financial stability.

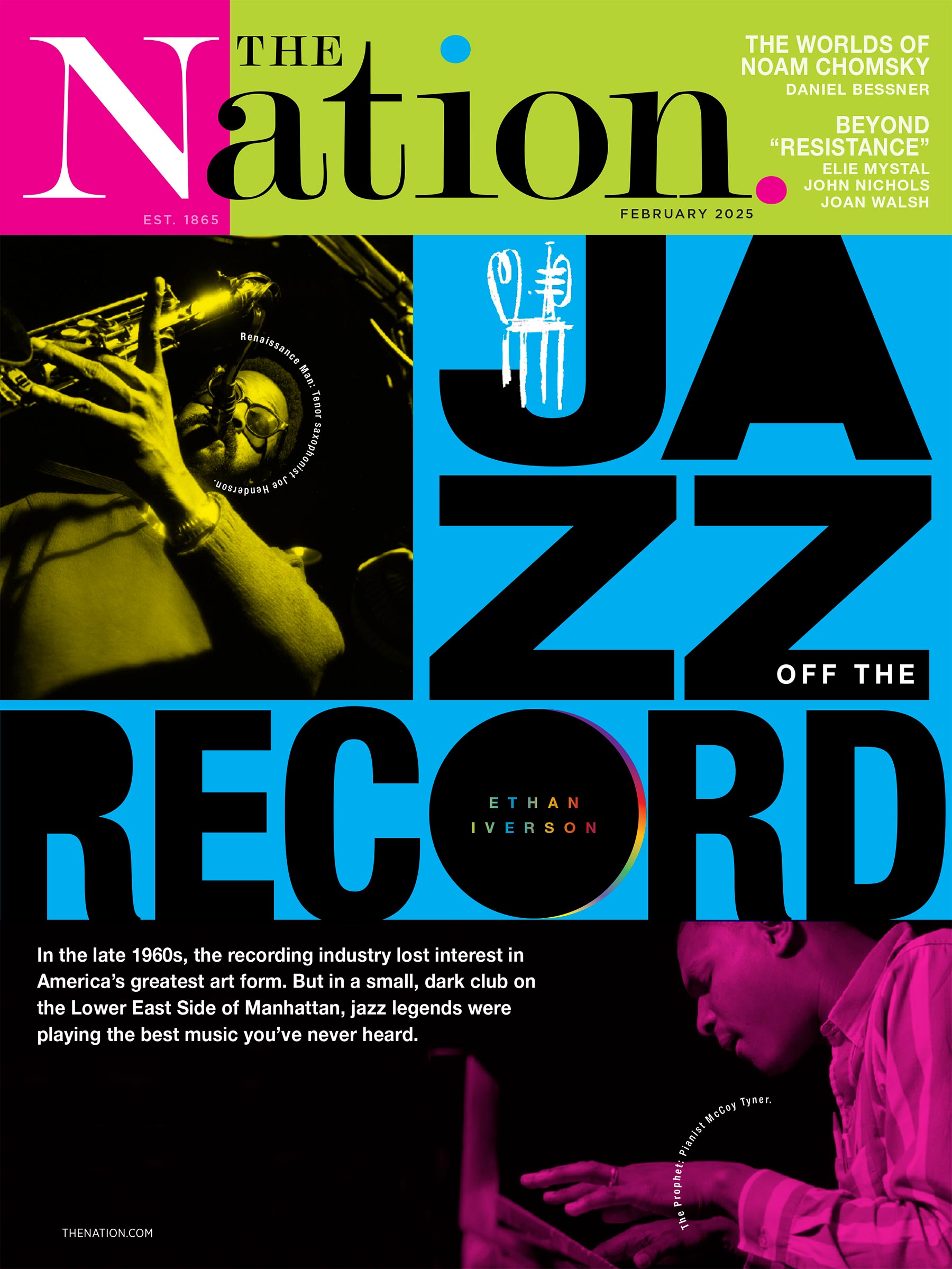

Current Issue

The Department of Education has been instrumental in creating the majority of repayment programs that help borrowers the most: the SAVE, Income-Contingent Repayment, and Pay As You Earn income-driven repayment (IDR) plans. These IDR plans provide borrowers with affordable monthly payments based on their income, helping millions of Americans stay in good standing, financially on track, and working toward debt forgiveness. Of course, these plans could be better, but they provide a foundation for advocates and officials to build on. For example, if IDR plans did not exist, the $188.8 billion in student debt forgiveness given to 5.3 million borrowers in the past four years would not have been possible.

Additionally, eliminating the Department of Education would leave an enormous gap in oversight and regulation, allowing servicers to operate with virtually no accountability. Borrowers already face challenges when servicers misapply payments, provide misinformation (yes, you can still apply for a different repayment plan), or fail to process applications for relief programs in a timely manner. Without a central agency dedicated to borrower advocacy and servicer accountability, these issues would escalate completely unchecked.

Despite these challenges, borrowers are far from powerless. Advocacy and preparation are vital tools for navigating an uncertain system and influencing its future. One immediate step folks can take is signing the Student Debt Crisis Center’s petition to defend the Department of Education. Staying informed and educated is equally important, and SDCC’s webinars and online resources offer insights into policy changes and guidance for making informed decisions. If borrowers feel they are not being treated fairly by servicers or are having consistent issues with their servicer or FSA account, they can get in touch with the Consumer Financial Protection Bureau or send a complaint to the Student Loan Ombudsman Office.

Finally, collective advocacy has the power to drive systemic change. Sharing stories, joining campaigns for debt reform, and participating in public forums can amplify borrowers’ voices and push policymakers to prioritize equitable solutions. Grassroots efforts have already led to significant wins, such as historic debt relief amounts under President Biden, temporary payment pauses, and expanded forgiveness programs.

The stakes borrowers face are high. The new administration’s suggestions that future debt cancellation and repayment options could be at risk are alarming. More confusion for borrowers is simply not the answer.